The Taskforce for Nature-Related Financial Disclosure (TNFD) is an international initiative to develop a market-led risk and disclosure framework that will assist businesses and financial institutions in identifying and acting on nature-related risks and opportunities (DCCEEW, 2023a). Designed for organisations of all sizes and sectors, this framework will assist businesses in implementing strategies that address their environmental impacts.

The framework is not a new standard, but an initiative modelled similar to the Taskforce of Climate-related Financial Disclosure (TCFD, 2023a). It is designed for organisations to disclose their climate-related risks and opportunities. Expanding on the concepts from the Taskforce of Climate-related Financial Disclosure, the Taskforce of Nature-related Financial Disclosures requires organisations to disclose their dependence on nature and their impacts or contribution of their activities on nature. Nature-related issues are location-specific, while climate-related issues cover a much broader area.

Nature Based Dependencies

The acknowledgement that biodiversity is an integral part of the business has increased as companies have become more cognisant of the economic values of nature. More than half of the world’s financial output is dependent on nature (DCCEEW, 2023b), with Australia relying on roughly 49% or $896 billion (ACF, 2022) for many industries (Figure 1), including agriculture, resources, fishing, forestry, and tourism.

Environmental trends have increased within organisations, and although climate action is becoming increasingly discussed and reported through organisation’s Environmental, Social and Governance Strategy (ESG), there has been less focus on evaluating and reporting biodiversity and natural capital dependencies, opportunities, risk and performance (PWC, 2023). By understanding nature-related dependencies, an organisation can then take action toward becoming more sustainable. One way to achieve this is to adopt the new Taskforce of Nature-related Financial Disclosures recommendations. This framework aims to accelerate the discussion around nature and business (TNFD, 2023b).

More than 150 companies worldwide have indicated that they will ensure their disclosure aligns with the new recommendations (Climateworks Centre, 2023). In Australia, this includes Accounting for Nature Ltd, Australia and New Zealand Banking Group Limited (ANZ), Woolworths Group and Stocklands (TNFD, 2023f).

These early adopters are expected to position themselves as market leaders, and those that have started adopting the Taskforce Recommendations will be publicly announced at the World Economic Forum Meeting in Davos, in January 2024.

Foundations for Understanding Nature and Business

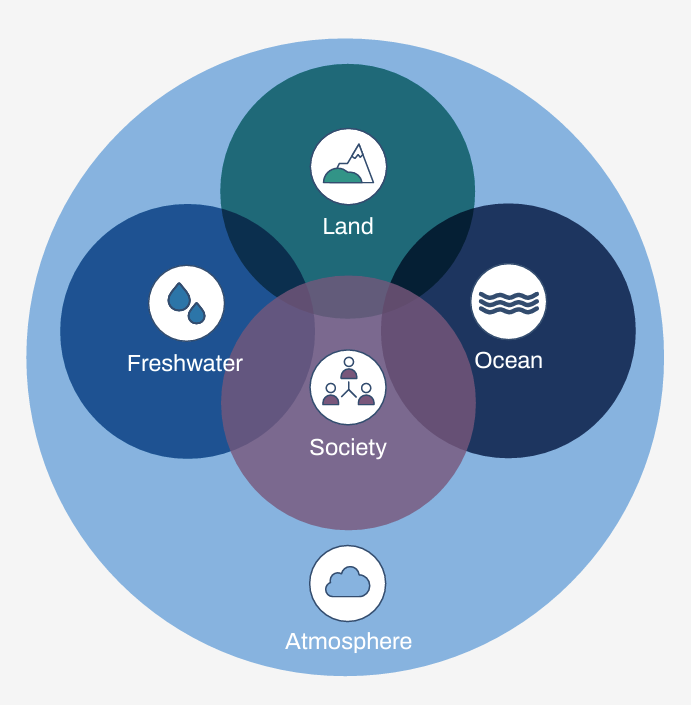

Nature refers to the natural world, emphasising biodiversity, their people and the interactions between the people and other organisms (TNFD, 2023d). It covers four realms: Land, freshwater, ocean, and atmosphere (Figure 2). The idea that society is in the centre of these realms suggests that all members of society have an impact on their surroundings and are a part of nature.

Interactions with Indigenous Peoples are significant due to their knowledge and community-led practices in the protection of ecosystems. While they only make up 5% of the world’s population, they have succeeded in protecting 80% of the global biodiversity (TCFD, 2023a) and continue to be stewards of the world’s remaining biodiversity, in addition to a source of traditional knowledge about the planet’s ecosystem.

What is Nature-Related Financial Disclosures

Nature-Related Financial Disclosures apply to reporting financial information related to an organisation’s impact on the natural environment and its dependencies (Grant Thornton, 2023). These disclosures are typically included in the companies’ financial reports to show how their activities may affect the environment. These disclosures help investors and the public understand the companies’ impact on climate change, biodiversity and natural resources. They provide information on the risks and opportunities related to nature and help stakeholders make informed decisions about who to invest in or support.

Some examples of disclosures that a company can include within their report are:

- Biodiversity Impact Assessments – Reporting on impacts to biodiversity due to the business activities,

- Water use and management – Detailing water consumption, conservation efforts and risks related to water scarcity,

- Renewable Energy Investments – Disclosing investments in renewable energy sources and their impact on the business,

- Natural Resource Management – Reporting on the sustainable use and management of natural resources (DCCEEW, 2023a).

Nature-Related Risks and Dependencies

Nature-related risks become real for a business when the business relies on nature for operations, supply chain and performance (PWC, 2023). The risk of relying on nature for operations, directly and indirectly, impacts the business as nature loss can trigger adverse outcomes. Consequences such as loss of raw materials, loss of customers, changes in market values and regulatory changes can all affect the financial performance of a business. Drivers of nature change can come from climate change; resource replenishment or use; pollution and the introduction of pests or diseases (Figure 3) (TNFD, 2023d).

How does the framework fit with other standards or reporting requirements?

The framework aims to complement and align with existing standards and reporting requirements; such as:

- The International Sustainability Standards Board (ISSB) is designed to be compatible with ISSB sustainability disclosure standards (IFRS, 2023).

- Global Reporting Initiative (GRI) (GRI, 2023)– it complements GRI standards by providing specific guidance on nature-related disclosures, helping companies enhance their reporting outputs.

- Investor expectations (LexisNexis, 2023)– With the increasing interest in sustainable investing consideration from investors, the framework could become a part of investor expectations. Adoption of the framework can increase investor attractiveness to the business.

How the Taskforce for Nature-related Financial Disclosure framework works

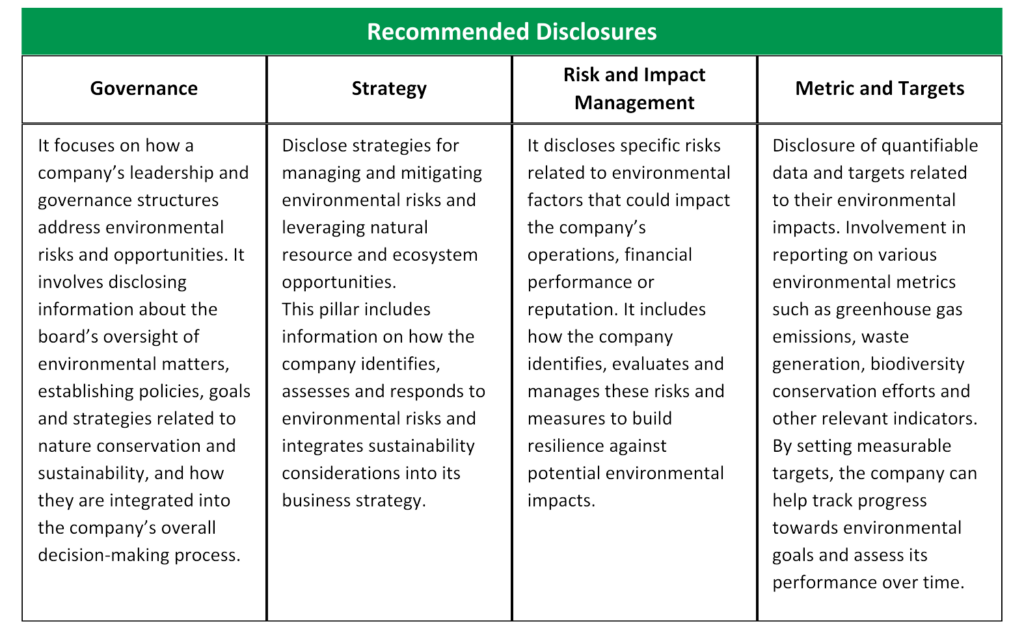

The Taskforce for Nature-related Financial Disclosure is built on four disclosure pillars: Governance, Strategy, Risk and Impact Management and Metrics and Targets (Table 1). These pillars are designed to enhance the quality and effectiveness of nature-related financial disclosures. It establishes standardised metrics and methodologies to assess and disclose nature-related information, allowing companies to integrate these into decision-making processes.

Within these pillars, there are 14 recommended disclosures, including:

- The application of materiality;

- The scope of disclosures;

- The location of nature-related issues;

- Integration with other sustainability disclosures;

- The time horizons considered and

- The engagement of Indigenous Peoples, Local Communities and affected stakeholders in identifying and assessing the organisation’s nature-related issues.

The LEAP Approach

The final release of the Taskforce of Nature-related Disclosures included LEAP (Locate, Evaluate, Assess and Prepare), a supporting guidance document designed to help companies undertake an internal due diligence assessment.

LEAP is a checklist that ensures that the process covers all the nature-related issues identified by the Taskforce’s recommended disclosures. LEAP stands for Locate, Evaluate, Assess and Prepare (TNFD, 2023c). LEAP is intended to be flexible in its application, as an organisation can utilise the tool to meet its own needs.

The Taskforce for Nature-related Financial Disclosure recommends considering two questions to help ensure alignment with goals and the expected outcomes of a LEAP assessment, which provides a scope for the framework of the LEAP approach (TNFD, 2023c).

- Generate a working hypothesis, and

- Align on goals and resourcing.

Generating a working hypothesis includes determining the organisation’s processes and activities likely to be material nature-related dependencies, impacts, risks and opportunities. This includes activities or assets within the organisation’s value chains, what sectors are involved, and revenue and expenditure of earnings associated with these activities.

Goals and Resource alignment include the organisation’s goals and expected outcomes of the LEAP assessment, the organisation’s approach to materiality, the key stakeholders, the baselines and periods for analysis, limitations and constraints and any boundaries around the analysis.

Once these questions are answered, the LEAP steps can be implemented (Figure 4).

Engagement with Indigenous Peoples, local communities and affected stakeholders is essential once the LEAP steps are finished. After completing a scenario analysis, companies can review, change and repeat this LEAP approach for each recommended disclosure.

What can you do to get ready for the Nature-Related Financial Disclosure

There is no single way to get started; each organisation is different and must adopt its own path. Some general steps that can be taken include (Grant Thornton, 2023):

- Understanding the Taskforce of Nature-related Disclosures framework, including its principles, pillars, and recommendations.

- Assess current business practices – evaluate current practices related to environment reporting and identify where nature-related disclosures are lacking or could be enhanced.

- Assess the existing data collection processes, metrics and reporting mechanisms.

- Conduct materiality assessment – identify the nature-related issues that are most common to your company’s operations, considering impacts on biodiversity, ecosystem services and dependencies on natural capital.

- Develop a stakeholder engagement strategy – including investors, clients, Suppliers, First Nations-led organisations and local communities.

- Develop a framework roadmap outlining how the company will integrate the framework into its reporting processes.

- Enhance data collection and measurement – improve data collection mechanisms to gather information.

For examples of reports, Forico, Tasmania’s leader in Forestry Management, has published an illustrative disclosure report that has provided an example of a way to report a company’s disclosures (Forico, 2023)

Integrate Sustainability strives to stay updated on the new research in the Environmental, Social and Governance Strategy area. If your company wants to explore options for integrating nature-related disclosures into environmental reports, call us at 08 9468 0338 or email us at enquiries@integratesustainability.com.au.

References

ACF. (2022). Report Explained: The nature-based economy: How Australia’s prosperity depends on nature. Retrieved 10 09, 2023, from https://www.acf.org.au/the-nature-based-economy-how-australias-prosperity-depends-on-nature

Australian Government. (2023). Climate-related financial disclosure: Second consultation. Retrieved from https://treasury.gov.au/consultation/c2023-402245

Climateworks Centre. (2023). Nature related disclosures are an important step on the path to help build an economy that works with, rather than against, nature. Retrieved from https://www.climateworkscentre.org/news/release-of-taskforce-on-nature-related-financial-disclosures-framework-a-welcome-step-and-australia-can-lead-on-nature-reporting/#:~:text=More%20than%20150%20companies%20worldwide,team%2C%20welcomed%20the%20TNFD%20a

DCCEEW. (2023a). Australian case study report on piloting the Taskforce on Nature-related Financial Disclosures framework. Retrieved from https://www.dcceew.gov.au/about/news/australian-case-study-report-on-piloting-tnfd-framework

DCCEEW. (2023b). Financing Solutions for Nature. Retrieved from https://www.dcceew.gov.au/climate-change/policy/nature-based-solutions-for-climate/financing-solutions

Forico. (2023). Illustrative Example of Integrated TCFD + TNFD Disclosures. Forico. Retrieved from https://tnfd.global/forico-publish-an-illustrative-nature-and-climate-related-disclosure-report-using-tnfd-and-tcfd-aligned-recommendations/

Grant Thornton. (2023, 05 24). TNFD: Getting started with nature-related disclosures. Retrieved from https://www.grantthornton.co.uk/insights/tnfd-getting-started-with-nature-related-disclosures/#:~:text=The%20TNFD%20disclosures%20guidelines,-Governance&text=Firms%20must%20disclose%20how%20they,relating%20to%20nature%2Drelated%20dependencies.

GRI. (2023). Our services and support. Retrieved from https://www.globalreporting.org/

IFRS. (2023). About the International Sustainability Standards Board. Retrieved from https://www.ifrs.org/groups/international-sustainability-standards-board/

IUCN. (2023). About IUCN. Retrieved from https://www.iucn.org/

LexisNexis. (2023). ESG issues—Investor expectations for 2023. Retrieved from https://lexisnexis.co.uk/blog/research-legal-analysis/esg-issues-investor-expectations-for-2023

Linsley, P., Abdelbadie, R., & Abdelbadie, R. (2023). The Taskforce on Nature-related Financial Disclosures must engage widely and justify its market-led approach. Nature Ecology & Evolution, 7, 1343–1346. doi:https://doi.org/10.1038/s41559-023-02113-w

PWC. (2023). Nature-related risks, opportunities and disclosures. Retrieved from https://www.pwc.co.nz/services/consulting/sustainability/nature-related-risks-opportunities-and-disclosures.html#:~:text=Aligning%20nature%20risk%20with%20existing%20risk%20categories&text=Just%20like%20storms%2C%20floods%2C%20heatwaves,performance%20and%

PWC. (2023). Taskforce on Nature-related Financial Disclosures (TNFD) beta framework. Retrieved from https://www.pwc.com.au/assurance/esg-reporting/beta-framework-tnfd.html

TCFD. (2023a). About. Retrieved from https://www.fsb-tcfd.org/about/

TNFD. (2022). The TNFD Nature-related Risk & Opportunity Management and Disclosure Framework. Retrieved from chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://tnfd.global/wp-content/uploads/2022/03/220321-TNFD-framework-beta-v0.1-FINAL.pdf

TNFD. (2023b). About us. Retrieved from https://tnfd.global/about/

TNFD. (2023c). Guidance on the identification and assessment of naturerelated issues: The LEAP approach. Retrieved from https://tnfd.global/publication/additional-guidance-on-assessment-of-nature-related-issues-the-leap-approach/

TNFD. (2023d). Recommendations of the Taskforce on Nature-related Financial Disclosures. Retrieved from https://tnfd.global/publication/recommendations-of-the-taskforce-on-nature-related-financial-disclosures/

TNFD. (2023e). Taskforce on Nature-related Financial Disclosures Pilots – Australian Case Study Report. Retrieved from https://www.dcceew.gov.au/environment/environmental-markets/financing-solutions-for-nature

TNFD. (2023f). The TNFD Community. Retrieved from https://tnfd.global/engage/tnfd-community/?_sfm_hq-country=Australia&sf_paged=4